VA Loans Can Help Veterans Achieve Their Dream of Homeownership

For over 78 years, loans backed by the Department of Veterans Affairs (VA) have provided millions of Veterans with the opportunity to purchase homes of their own. If you or a loved one have served or are currently serving, it’s important to understand this program and its benefits.

Here are some things you should know about VA loans before you start the homebuying process.

What Are VA Loans?

Are you a military service member or veteran looking to buy a home? As a benefit of your service, the Department of Veterans Affairs offers unique resources to help those with military experience purchase a home with a low or zero down payment. The VA Loan is a valuable tool that military members and veterans may use to pursue home ownership. VA Loans offer flexible options as either Fixed Rate or Adjustable Rate mortgages.

VA loans provide the buyer the chance to finance 100% of the purchase price of the home, meaning no down payment is required. It is important to note that buyers will still need to qualify for the loan. This means that lenders will look at their credit and ability to pay the mortgage. If you are in a troubling financial position, a lender may want to see you pay down debt or save up money before they are willing to give you the loan.

You may also be responsible for closing costs, such as recording the title or paying lawyers to draw up all paperwork. This is negotiable with the seller and something to discuss with your realtor before making an offer on a home.

The U.S. Department of Veterans Affairs describes the program like this:

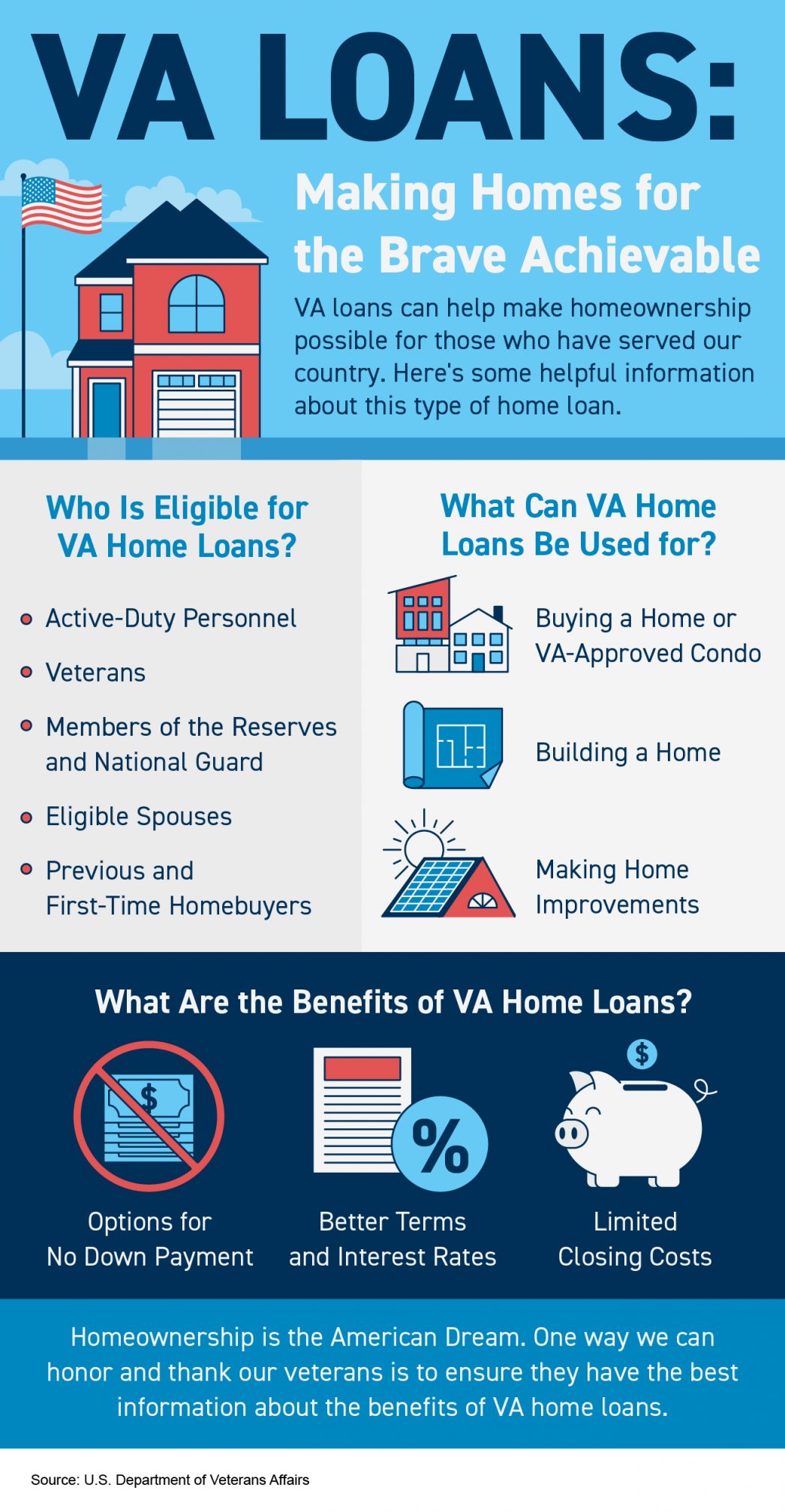

The VA helps Servicemembers, Veterans, and eligible surviving spouses become homeowners. As part of our mission to serve you, we provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy.”

Top Benefits of the VA Home Loan Program

In addition to helping eligible buyers achieve their homeownership dreams, VA loans have several other great benefits for buyers who qualify. According to the Department of Veteran Affairs:

- Qualified borrowers can often purchase a home with no down payment.

- Many other loans with down payments under 20% require Private Mortgage Insurance (PMI). VA Loans do not require PMI, which means veterans can save on their monthly housing costs.

- VA-Backed Loans often offer competitive terms and mortgage interest rates.

A recent article from Veterans United sums up just how impactful this loan option can be:

For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.”

John Bell, Acting Executive Director of the Department of Veterans Affairs Loan Guaranty Service, also explains why this program is so powerful:

“It provides early ownership for many people that would not have that opportunity to begin with. Since there’s no down payment, it allows people to hold their wealth and it gives them the ability to have long term financial security by being able to own a house and let that equity grow.”

Bottom Line

Homeownership is the American Dream. Our Veterans sacrifice so much in service of our nation, and one way we can honor and thank them is to ensure they have the best information about the benefits of VA home loans. If you are serving currently or have served, thank you for your service! If you’d like to learn more about VA Loans, we’d love the opportunity to serve you! Contact us today to learn more.